Iowa Property Tax Assistance . you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. last review and update: applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. 2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. Many people with a disability own or are buying their homes. if you are unable to pay taxes, check out our articles on tax suspension and tax credits at tax suspension and tax. Iowa law allows people who. filing for your homestead exemption.

from taxfoundation.org

2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. Iowa law allows people who. Many people with a disability own or are buying their homes. if you are unable to pay taxes, check out our articles on tax suspension and tax credits at tax suspension and tax. filing for your homestead exemption. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. last review and update:

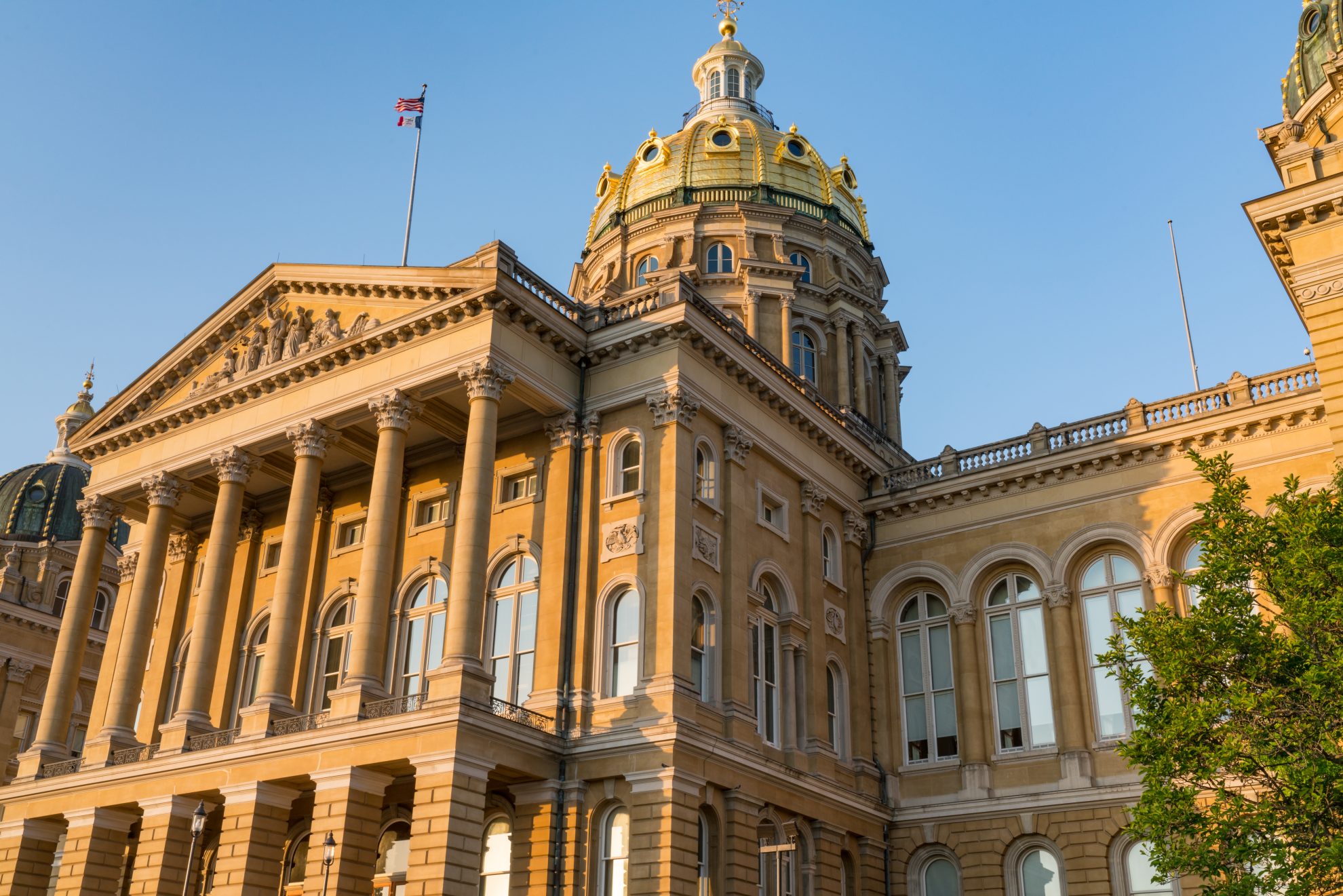

Iowa Property Tax Reform Plan Misses the Mark Tax Foundation

Iowa Property Tax Assistance Many people with a disability own or are buying their homes. you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. filing for your homestead exemption. if you are unable to pay taxes, check out our articles on tax suspension and tax credits at tax suspension and tax. last review and update: Many people with a disability own or are buying their homes. 2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. Iowa law allows people who.

From www.xoatax.com

Iowa Property Tax Key Information 2024 Iowa Property Tax Assistance 2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. Iowa law allows people who. you should apply for a property tax credit or reduced tax rate. Iowa Property Tax Assistance.

From www.templateroller.com

Form 54001 Download Printable PDF or Fill Online Iowa Property Tax Iowa Property Tax Assistance last review and update: filing for your homestead exemption. you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. Many people with a. Iowa Property Tax Assistance.

From www.winnebagocountyiowa.gov

Property Taxes Treasurer Winnebago County, IA Iowa Property Tax Assistance Many people with a disability own or are buying their homes. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. last review and update: Iowa law allows people who. filing for your homestead exemption. if you are unable to pay taxes, check out our articles. Iowa Property Tax Assistance.

From www.youtube.com

Receive Property Tax Assistance Orland Township YouTube Iowa Property Tax Assistance if you are unable to pay taxes, check out our articles on tax suspension and tax credits at tax suspension and tax. filing for your homestead exemption. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. you should apply for a property tax credit or. Iowa Property Tax Assistance.

From itrfoundation.org

A Needed Reform for Iowa’s Property Taxpayers ITR Foundation Iowa Property Tax Assistance 2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. Many people with a disability own or are buying their homes. last review and update: if you are unable to pay taxes, check out our articles on tax suspension and tax credits at tax suspension and tax.. Iowa Property Tax Assistance.

From www.youtube.com

The Truth About Iowa Property Tax Assessments YouTube Iowa Property Tax Assistance filing for your homestead exemption. you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. 2023 iowa property tax credit claim form (elderly. Iowa Property Tax Assistance.

From islandstaxinformation.blogspot.com

Iowa Property Tax Calculator Iowa Property Tax Assistance Many people with a disability own or are buying their homes. filing for your homestead exemption. you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or. Iowa Property Tax Assistance.

From www.templateroller.com

Form 54001 2022 Fill Out, Sign Online and Download Printable PDF Iowa Property Tax Assistance filing for your homestead exemption. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. Many people with a disability own or are buying. Iowa Property Tax Assistance.

From itrfoundation.org

Time to Solve Iowa’s Property Tax Problem ITR Foundation Iowa Property Tax Assistance 2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. filing for your homestead exemption. Iowa law allows people who. if you are. Iowa Property Tax Assistance.

From www.blackhawkcounty.iowa.gov

Payment Options for Property Taxes Black Hawk County IA Iowa Property Tax Assistance last review and update: Iowa law allows people who. you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. filing for your homestead. Iowa Property Tax Assistance.

From dxooytboe.blob.core.windows.net

Scott County Iowa Property Tax Calculator at Stephan Riley blog Iowa Property Tax Assistance 2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. Iowa law allows people who. Many people with a disability own or are buying their homes. last. Iowa Property Tax Assistance.

From www.blackhawkcounty.iowa.gov

Payment Options for Property Taxes Black Hawk County IA Iowa Property Tax Assistance last review and update: you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. filing for your homestead exemption. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. 2023 iowa property. Iowa Property Tax Assistance.

From itrfoundation.org

Iowa’s High Property Taxes ITR Foundation Iowa Property Tax Assistance 2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. Many people with a disability own or are buying their homes. last review and update: Iowa law allows people who. filing for your homestead exemption. applicant must be behind at least 30 days behind on payments. Iowa Property Tax Assistance.

From www.youtube.com

A Solution to Iowa’s Property Tax Problem YouTube Iowa Property Tax Assistance Many people with a disability own or are buying their homes. if you are unable to pay taxes, check out our articles on tax suspension and tax credits at tax suspension and tax. Iowa law allows people who. last review and update: you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes. Iowa Property Tax Assistance.

From www.formsbank.com

Instructions For Form 54002 Iowa Property Tax Credit Claim 2012 Iowa Property Tax Assistance filing for your homestead exemption. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. if you are unable to pay taxes, check out our articles on tax suspension and tax credits at tax suspension and tax. last review and update: Many people with a disability. Iowa Property Tax Assistance.

From kayleahailie.blogspot.com

20+ Iowa Property Tax Calculator KayleaHailie Iowa Property Tax Assistance 2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. last review and update: Many people with a disability own or are buying their homes. filing for your homestead exemption. applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured. Iowa Property Tax Assistance.

From islandstaxinformation.blogspot.com

Iowa Property Tax Calculator Iowa Property Tax Assistance applicant must be behind at least 30 days behind on payments for mortgage, contract sale, manufactured home or property taxes. Many people with a disability own or are buying their homes. 2023 iowa property tax credit claim form (elderly & disabled tax credit) property tax credit is for iowa resident homeowners. if you are unable to pay. Iowa Property Tax Assistance.

From twitter.com

Polk County Iowa on Twitter "Property owners will find new assessments Iowa Property Tax Assistance if you are unable to pay taxes, check out our articles on tax suspension and tax credits at tax suspension and tax. you should apply for a property tax credit or reduced tax rate for 2023/2024 taxes between january 1 and june 1 of 2023. filing for your homestead exemption. last review and update: 2023. Iowa Property Tax Assistance.